As talks about extending the Tax Cuts and Jobs Act (TCJA) heat up, policymakers are examining different tax policy changes to help balance the budget.

Yale’s Budget Lab is studying various potential focus areas and, on January 24, 2025 zeroed in on Section 1202 of the Internal Revenue Code (IRC)—the Qualified Small Business Stock (QSBS) exclusion.

While Yale’s findings highlight potential revenue gains if QSBS were to be curtailed or completely cut, other research warns that changes to QSBS could have serious long-term consequences for job creation, innovation, and U.S. competitiveness.

The Purpose of QSBS and How It Works

Introduced in 1993, QSBS lets investors exclude up to 100% of capital gains from the sale of stock in certain small businesses. The goal is to reduce capital costs, encourage investment, and fuel business growth. To qualify, businesses must be C-corporations with less than $50 million in assets, and investors must hold the stock for at least five years.

Yale’s research points out that most businesses today aren’t structured as C-corporations but rather are organized as pass-through entities like S-corporations or LLCs. In fact, according to the study, only 5% of small businesses were C-corporations in 2014, compared to 89% organized as pass-throughs. This means the tax benefit is only reaching a limited segment of businesses, often larger ones capable of generating significant capital gains. Such a comparison, however, fails to reflect that the startup companies included in the 5% of companies founded as C-corporations account for a disproportionate portion of new innovation and job creation.

Looking at the Bigger Picture

Yale’s Budget Lab estimates that eliminating QSBS could raise over $81 billion in additional federal revenue over the next 10 years. In their January 31, 2025 policy brief, Carta’s policy team warned that focusing solely on short-term revenue overlooks the broader, long-term impacts on the economy. They argue that QSBS is critical to helping startups attract the capital and talent they need to grow—and curtailing it could have lasting negative effects.

Their rebuttal stresses that startups are inherently risky, with one-third failing in their first year and half failing within five years. QSBS rewards investors willing to take those risks, helping entrepreneurs secure the funding needed to build businesses, create jobs, and innovate.

“Adjusting or eliminating QSBS would raise revenue. Initially. But the long-term impact will be devastating,” says Anthony Cimino and Holli Heiles Pandol from Carta’s Policy Team. They point out that startups and small businesses drive over 2 million net new jobs annually, with high-growth firms responsible for 50% of that growth.

Additionally, QSBS is America’s version of similar policies in other countries, such as EIS in the UK. So, reducing or eliminating QSBS could place the US at a competitive disadvantage.

Exploring Potential Policy Options

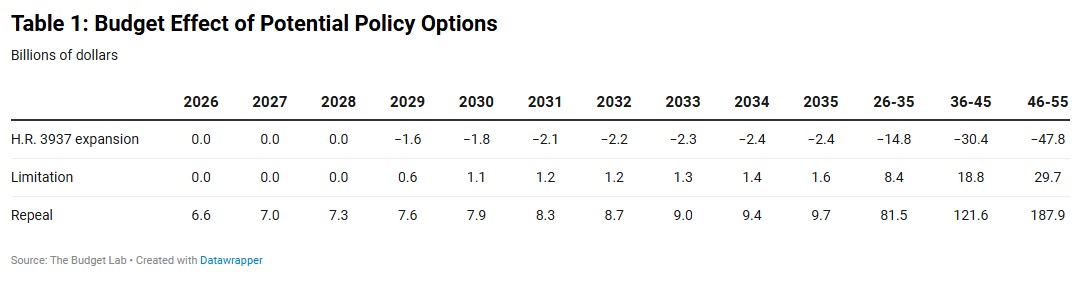

In its study, Yale’s Budget Lab analyzed three possible policy paths regarding QSBS: expansion, limitation, and elimination of the Section 1202 exclusion. Here’s a summary of the options and their projected effects:

-

Expansion of the Exclusion (H.R. 3937 – Small Business Jobs Act – a proposal initially introduced by Congressman Kustoff in 2023)

This proposal would shorten the required holding period to phase in the QSBS exclusion, whereby stock held for three years would qualify for a 50% exclusion, then 75% after 4 years, and 100% after 5 years. Additionally, certain stocks issued by S-corporations would now qualify for the exclusion.

Projected Impact (Yale’s Estimate): A $15 billion revenue loss over the next ten years (2026-2035). -

Revenue-Raising Option (Extended Holding Period)

This option would require a seven-year holding period for the full 100% exclusion. Stocks held for five years would receive only a 50% exclusion, while those held for six years would qualify for a 75% exclusion.

Projected Impact (Yale’s Estimate): A $8.5 billion revenue gain over the ten-year period. -

Full Elimination of the Exclusion

Yale examined the impact of eliminating the exclusion entirely.

Projected Impact (Yale’s Estimate): Over $81 billion in additional revenue from 2026 to 2035.

Don’t Lose Sight of the Big Picture

As Carta’s Public Policy team emphasized, QSBS benefits more than just investors. It supports founders and employees who own nearly half of QSBS-eligible shares. Without QSBS, the cost of capital for startups could increase, discouraging entrepreneurship and making it harder to recruit talent.

“QSBS drives economic growth,” Cimino argues. “Today, approximately 50% of public companies and eight of the top 10 publicly traded companies by value were venture-capital-backed. Cutting QSBS could hurt that pipeline.”

They also point out that while Yale estimates a potential $81 billion revenue gain, it’s hard to quantify the downstream losses from fewer startups, slower job growth, and reduced innovation, and therefore, the true cost of eliminating QSBS could exceed any immediate revenue gains.

Where the Debate Stands

The conversation around QSBS isn’t just academic—it’s part of ongoing legislative discussions. Speaker Mike Johnson is aiming to pass a tax bill by the end of April, and modifications to QSBS have been floated as a possible revenue-raising measure. Yale’s report has drawn attention from policymakers, and organizations, including CapGains Inc., are actively engaging with congressional staff to make their case for preserving the exclusion.

What’s Next?

The debate over QSBS highlights policymakers’ broader challenge when balancing short-term budgetary needs with long-term economic growth. Yale’s findings clearly show there is revenue potential from limiting or eliminating QSBS, but it is critical to ask at what cost and how large a risk such a change would pose to undermining America’s startup ecosystem.

As lawmakers consider changes to QSBS, they’ll need to weigh both perspectives carefully. Will they prioritize immediate revenue gains or long-term innovation and job growth? The answer could have lasting consequences for the future of small businesses in the U.S.

Sources: The Budget Lab at Yale University, January 24, 2025.

This article does not constitute legal or tax advice. Please consult with your legal or tax advisor with respect to your particular circumstance.