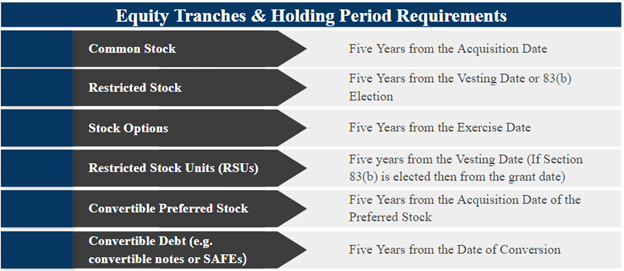

The required holding period for Section 1202 QSBS starts the day the stock is acquired/issued. If stock was acquired through other securities such as convertible debt or stock options, the holding period for QSBS generally starts on the date the securities are converted to the stock.

The following list shows the holding period timelines for various security types.

More on the QSBS holding period

This article does not constitute legal or tax advice. Please consult with your legal or tax advisor with respect to your particular circumstance.

This article does not constitute legal or tax advice. Please consult with your legal or tax advisor with respect to your particular circumstance.