The Qualified Small Business Stock (“QSBS”) tax exclusion is one of many incentives the US Federal government has enacted to encourage founding and investing in new businesses.

This exemption can be significant, with up to a benefit of approximately $2 million per taxpayer per investment (based on the $10mm exclusion cap for married taxpayers multiplied by a 20% capital gains tax rate). If the taxpayer is also subject to the Net Investment Income Tax, this 3.8% is also excluded, bringing the maximum possible tax savings to $2.38 million per investment!

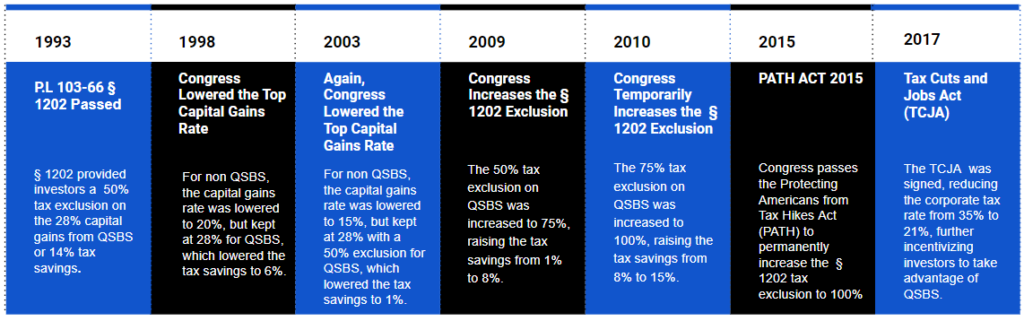

The QSBS exclusion dates back to 1993, with the passage of the Omnibus Budget Reconciliation Act of 1993. These incentives have since been formalized in Section 1202 of the Internal Revenue Code.

The Benefit Has Only Increased since 1993

The Section 1202 Qualified Small Business Stock (QSBS) capital gain tax exclusion on the sale of stock has been adjusted several times since 1993, with different exclusion levels as of each date the law was revised.

- 50% exclusion if the QSBS was acquired after August 10, 1993, but before February 17, 2009

- 75% exclusion if acquired after February 17, 2009, but before September 27, 2010

- 100% exclusion if acquired after September 27, 2010

The following chart details the history of these revisions to the QSBS gain exclusion:

More on calculating your QSBS exclusion

This article does not constitute legal or tax advice. Please consult with your legal or tax advisor with respect to your particular circumstance.