A tax-free stock transaction happens when stock is transferred or exchanged without realizing any gains on the stock. A few examples of tax-free transactions that maintain QSBS status are (i) gifted stock, (ii) stock inherited after a death, whether through an estate or other means, (iii) from a partnership to a partner, (iv) through a section 351 stock exchange, or (v) through a section 368 reorganization.

Can I gift my stock without paying taxes and the giftee keeps my QSBS status?

Possibly no taxes but yes the giftee will maintain QSBS status as well as keep the timeline that the stock has been held, referring to the five-year holding period. Gift taxes are very straightforward, as of 2019 a taxpayer could gift up to $15,000 to each individual without paying taxes or elect the lifetime gift exclusion of $11.4M.

What if my gift is to an organization or my families partnership?

According to Section 1202, an individual must receive QSBS either directly from the issuing company or through a gift or inheritance. Partnerships or LLC are allowed to transfer QSBS to a partner but not vis versa. A partnership or LLC is not a stand-alone entity but a pass-through; therefore, if QSBS is gifted or transferred to the partnership the partners would be receiving the gift or transfer indirectly and not directly. Many high net worth individuals use a Family Limited Partnership (FLP) as tax shelter from current or future gifting taxes, but if the QSBS is transferred to the FLP it will not maintain its status.

Now that I know I can’t gift my stock to my families partnership, can I set up a trust for my kids?

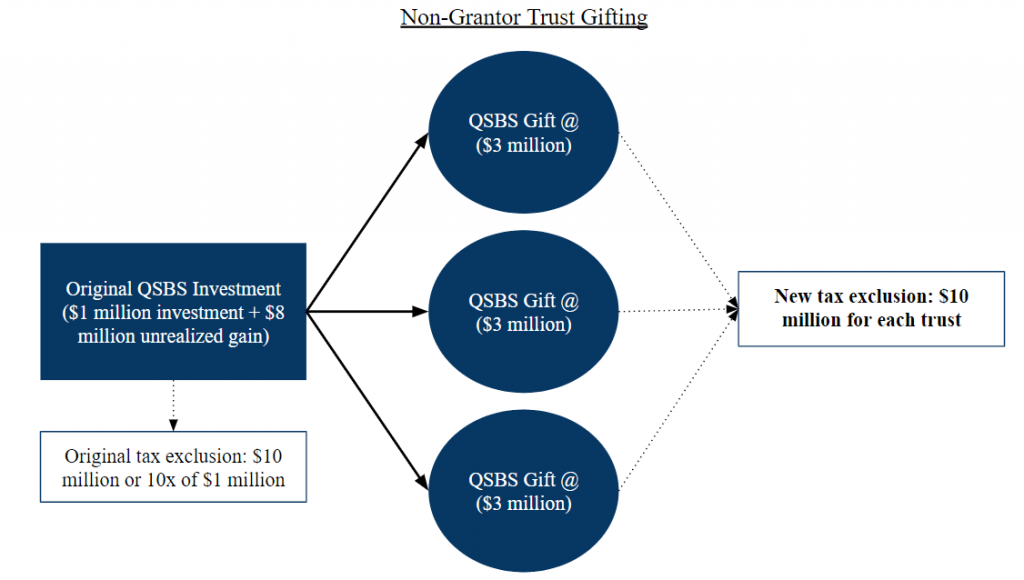

The IRC Section 1202 does not explicitly address transfers to trusts, but it can be implied that if the QSBS transfer is considered donative the QSBS will maintain its holding period and qualification. Under Section 1202(g) any common trust fund is eligible to be a holder of QSBS. There are two tax planning strategies, involving a grantor trust (controlled by the grantor) and a non-grantor trust (controlled by the donee or who the trust has been set up for). If the transfer is considered donative the grantor trust will maintain the QSBS qualification as if the transfer never happened. The more complex tax planning strategy involves a non-grantor trust. For example, an investor invested in an early-stage startup that turned out to be a unicorn investment. The investor creates three non-grantor trusts, one for each of his kids. The investor gifts each of his kids a third of the stock. Under Section 1202(h)(2) the donee of the gifted stock will maintain the full tax exclusion and holding period. Therefore, all three non-grantor trusts will have their own $10 million or 10x tax exclusion, allowing the original investor to create a myriad of tax exclusions.

Now that I have these completed trusts set up my business was acquired in a tax-free Section 368 stock-for-stock exchange?

Well… now it gets even more complicated. If a company is acquired in an all-stock acquisition within boundaries of a Section 368 reorganization than the transaction will be tax-free as well as qualify for QSBS. In short, the acquiring company exchanges a portion of its existing stock or issues new shares for the entire equity pool of the target (i.e. your company). There are two scenarios (i) the stock is exchanged for new QSBS in the acquiring company or (ii) the stock is exchanged for non-QSBS in the acquiring company. Scenario one is treated as if nothing happened (i.e. your new QSBS is still QSBS with the old QSBS timeline and can still accumulate excludable gains) other than some tax reporting, but scenario two is not treated differently because it is exchanged for non-QSBS. Scenario two can no longer accumulate excludable gains the gain on the Section 368 transaction is the full gain that can be excludable, but Section 368 does allow you to hold the non-QSBS through the end of your five-year holding period without reporting any gains on your taxes.

After reading over more QSBS Expert I realized my company was structured as an LLC this whole time…. am I doomed or can I fix this?

Under Section 1202 a qualified small business must be an operating company that is structured as a C Corporation. Even if the company was founded under a different legal structure the company can be restructured or dissolved into a C Corporation. The new C Corporation would issue QSBS with the five-year timeline starting on the day of issuance. Utilizing a Section 351 stock exchange allows business owners to incorporate a new entity structured as a C Corporation and exchange all of the stock or assets in the existing LLC for 100% ownership in the new C Corporation. Although the timeline starts on the day of the issuance of the exchanged stock it paves a new road for equity holders to qualify for Section 1202.

I know it’s a lot but don’t stop reading yet there is one more scenario that could help you save big in taxes.

For example, a company could be founded with assets worth $1M under an LLC legal structure taxed as a partnership. Over time the business is successful, bolstering the balance sheet with a fair market value (FMV) of assets worth $50M. The business owner can take advantage of Section 351 tax-free transaction by incorporating a new entity as a C Corporation under Section 351 and transferring the LLC’s assets for newly issued QSBS tax-free. Under Section 1202(i) the business owners can contribute appreciated property in exchange for QSBS with the basis being no less than the FMV. Therefore, the business owner would have a basis of $50M in the newly issued QSBS instead of the $1M original basis as well as paying no taxes on the appreciated property. This restructuring strategy would give the business owner an eligible gain exclusion of up to $500M ($50M x 10) instead of $10M ($1M x 10).

Does the holding period restart for tax-free transfers?

This article does not constitute legal or tax advice. Please consult with your legal or tax advisor with respect to your particular circumstance.