In today’s global economy, innovation remains on the central stage as the key enabler that leads to growth. Thus, it is important to have legislation that supports these fresh and innovative enterprises. One of the prominent policies in this area is the Qualified Small Business Stock (QSBS), a tax advantage enacted by Congress under section 1202 of the US Internal Revenue Code in 1993.

Influence of QSBS on Investment and Talent Recruitment

Most startups don’t succeed. As demonstrated by the Bureau of Labor Statistics, roughly 20% of startups do not survive their first year, and the statistics keep growing each subsequent year. Within a decade, 65% shutter their operations. The Harvard Business Review also reports that two-thirds of these emerging companies fail to generate returns for their investors. This makes venturing into a startup inherently risky. But why take the risk? Investors understand that should an innovative start-up hit the market, they could retrieve 10x their investment, if not more. And QSBS sweetens the deal even more by offering significant tax benefits on capital gains.

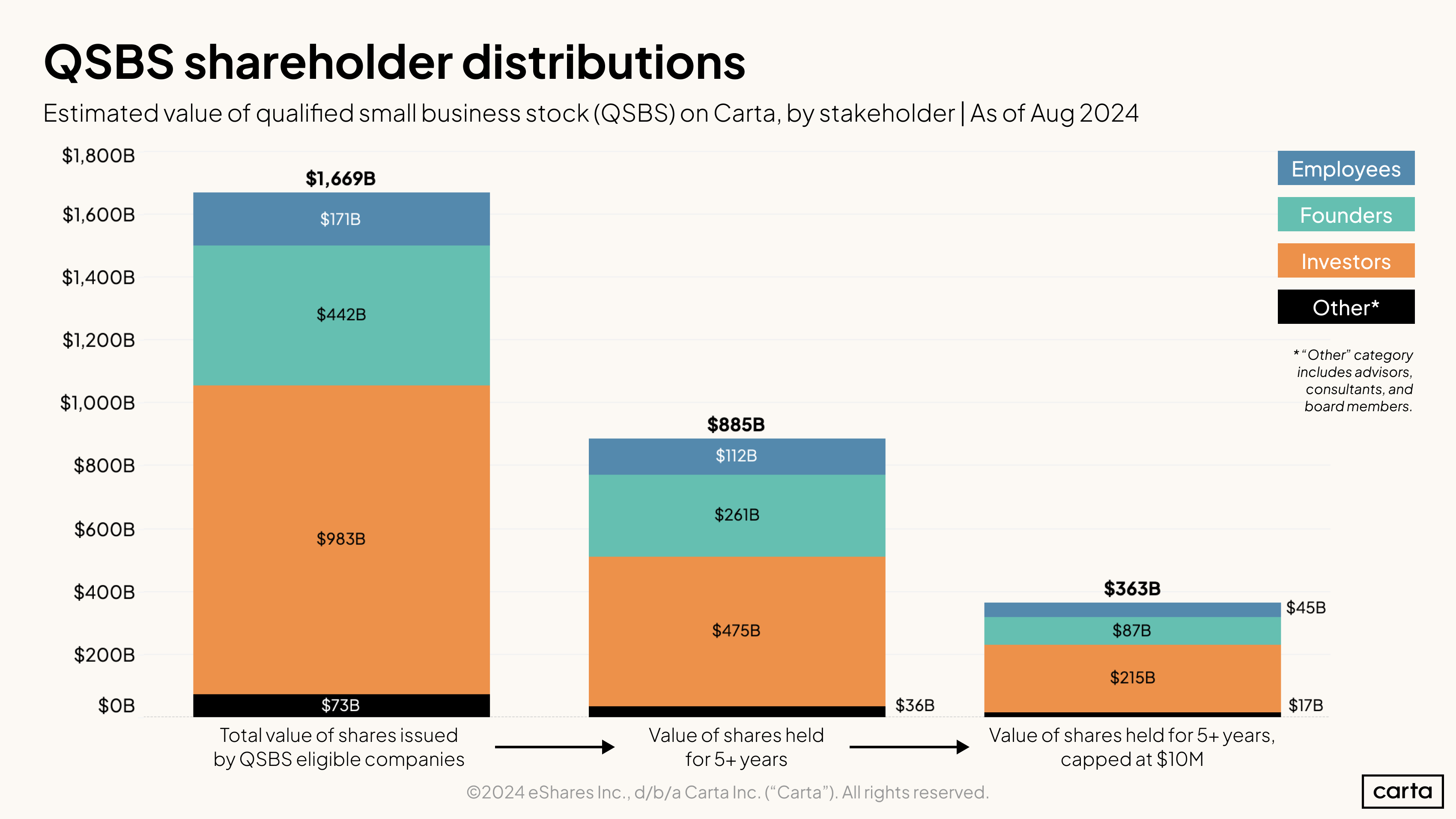

Since 2010, investors can now exclude up to 100% of their capital gains when selling stock eligible for QSBS. The tax benefit is capped at $10 million or 10x the investor’s cost basis, whichever is greater, and this limit applies per company. This cap allows investors who have made gains from multiple qualifying companies to potentially exclude significant amounts of capital gains.

QSBS also plays a dual role in the startup ecosystem. It reduces financial risk for investors but also aids startups in attracting and retaining top talent.

Research by Carta and this article by Anthony Cimino, Carta’s Head of Policy, explains how QSBS can help initiate this growth and success in startups.

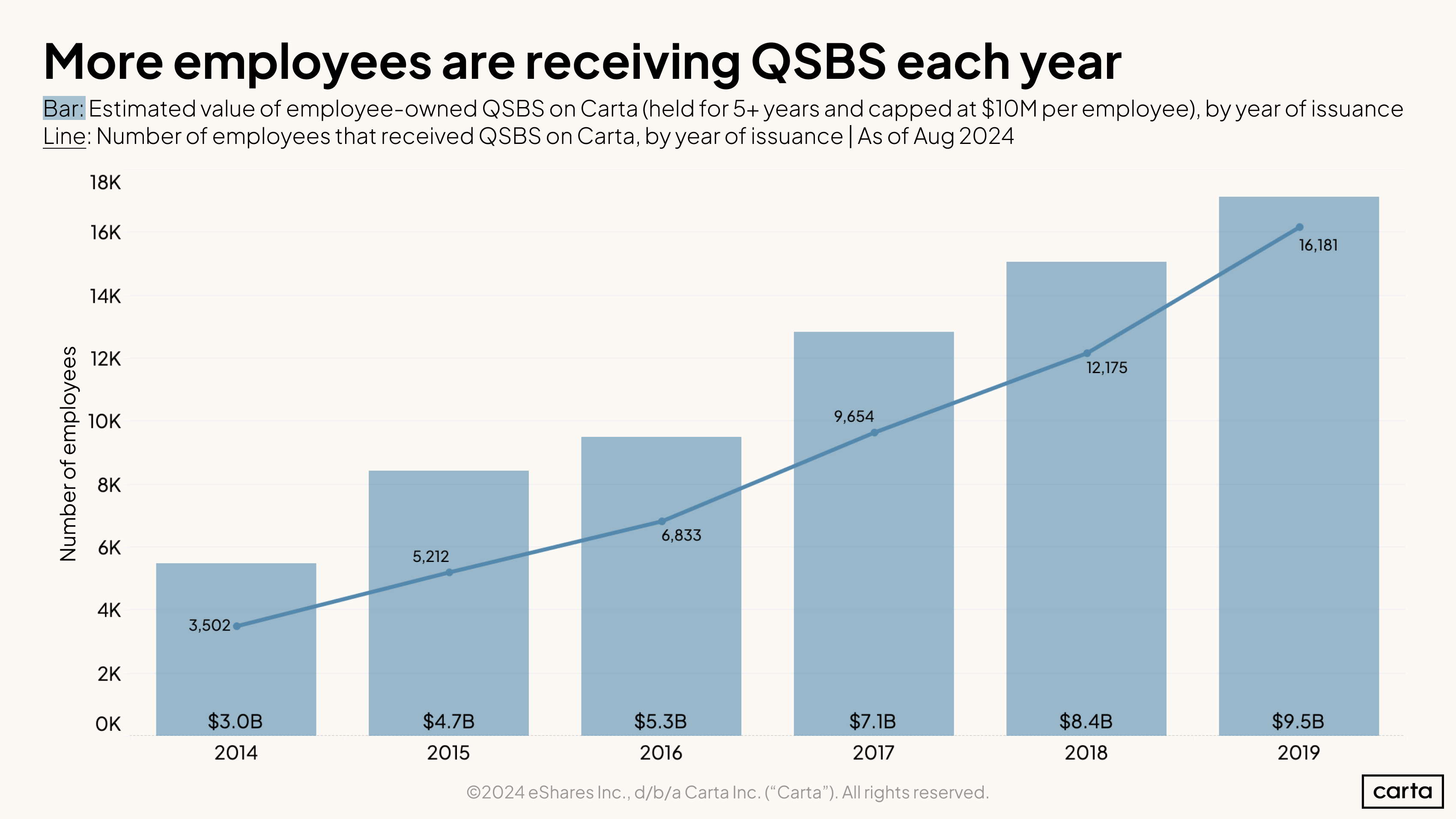

Cimino mentioned that employees are often more inclined to join early-stage companies, even if it means sacrificing higher salaries at established firms. This is partially driven by the chance of QSBS tax-free gains, which makes the risk more acceptable.

Source: Carta (2024)

Source: Carta (2024)Carta’s analysis highlights that 45% of QSBS holders on their platform are founders and employees. Their data also shows a corresponding increase in QSBS-eligible employees as the startup economy rapidly grows. This growth demonstrates a dynamic and ever-changing environment supported by a venture-backed startup landscape, where equity compensation is a valuable tool.

Source: Carta (2024)

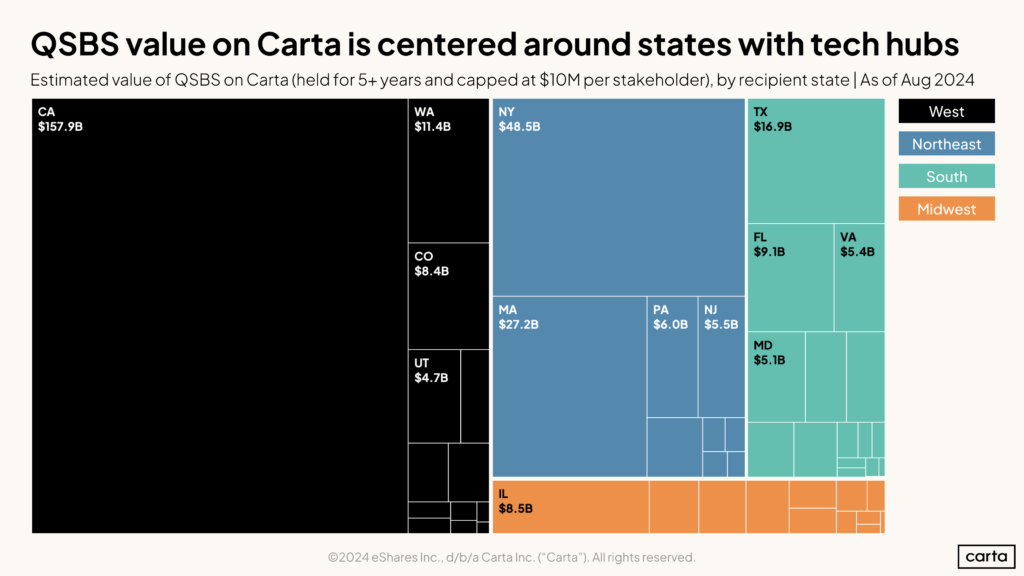

Source: Carta (2024)Geographic Distribution and Ecosystem Benefits

Areas that reap most of the QSBS benefits are located in well-established venture hubs like California, New York, and Massachusetts. These regions are home to many QSBS-eligible C-corporations and have a strong network of accredited investors. Cimino relates that this fosters a positive cycle of local investment and promotes the growth of startups. By creating a supportive ecosystem for startups, QSBS plays a crucial role in encouraging the growth of angel investors and driving regional economic development.

Source: Carta (2024)

Source: Carta (2024)Enhancing QSBS

Although the QSBS policy has achieved notable successes, certain limitations could be addressed to cater to the changing startup landscape more effectively. Cimino proposed several changes that could widen both QSBS-eligible corporations and shareholders. These include:

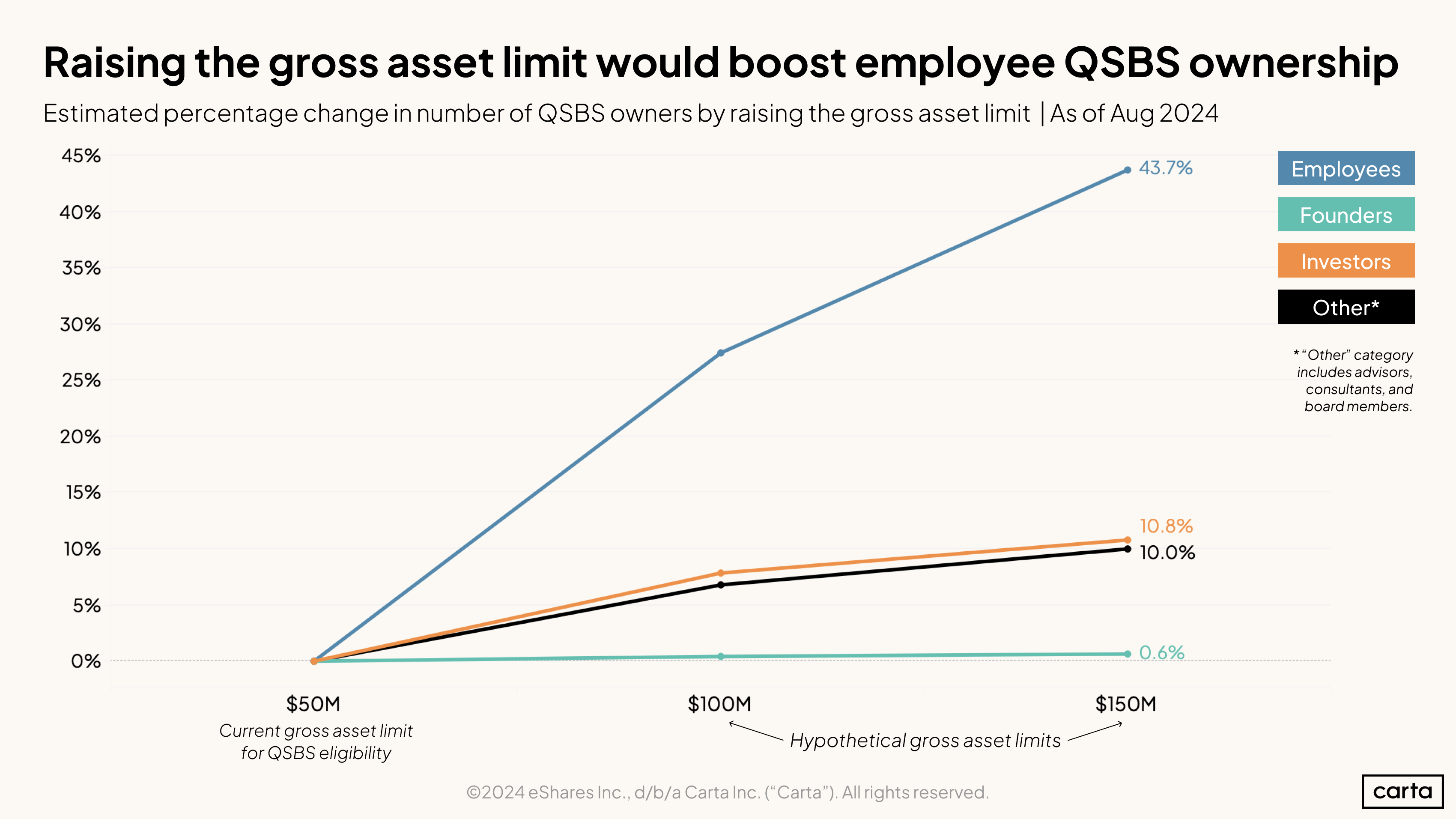

Raising the Gross Asset Threshold

The current $50 million threshold, after which companies can no longer issue QSBS-eligible stock, was established in 1993 and has failed to keep up with inflation and the increasing costs of doing business. Based on Carta’s analysis, the number of equity holders eligible for QSBS will increase by 10% if the threshold is raised to $100 million or $150 million. Leading to a potentially significant increase in employee ownership by over 40%.

Source: Carta (2024)

Source: Carta (2024)Expanding Eligibility

At present, the benefits of QSBS only apply to C-corporations. Expanding the policy to include other business entities, such as LLCs, would allow a wider range of startups to benefit from this advantage.

Clarification of SAFEs and Convertible Notes as QSBS-eligible stocks

Adding convertible notes and Simple Agreements for Future Equity (SAFEs) to QSBS eligibility would streamline investment and equity arrangements, making it more convenient for startups to secure early-stage capital.

Expanding QSBS to entities other than C-corporations and other types of securities is both included in legislation introduced in 2022 by Congressman Kustoff.

Final Thoughts

Carta’s research highlights the ongoing significance of QSBS as a valuable tool for fostering innovation and attracting talented individuals to startup ventures. Updating the policy to align with the current economic landscape and expanding its scope will greatly enhance its impact, enabling many founders and employees to benefit from this vital tax incentive. Looking ahead, it is essential to maintain and improve QSBS to support a thriving startup ecosystem.

Sources

Cimino, A. (2024, August 13). Carta Policy Insights: Decoding the data | QSBS. Retrieved from Carta: https://carta.com/blog/policy-insights-08-2024/?utm_medium=email&utm_source=blast&utm_campaign=20240813-amer-general-policy_newsletter&utm_content=&mkt_tok=MjE0LUJURC0xMDMAAAGU66fRhucM9glDmCckCtn-eF2ia-PcUeHs18JLGPyxzOH_4bPg6WuvsPsKw1quhbXtN_pgr83s6IADnXd

U.S. Bureau of Labor and Statistics. (2024, August 21). Business Employment Dynamics. Retrieved from Bureau of Labor and Statistics: https://www.bls.gov/bdm/us_age_naics_00_table7.txt

This article does not constitute legal or tax advice. Please consult with your legal or tax advisor with respect to your particular circumstance.

Source: Carta (2024)

Source: Carta (2024) Source: Carta (2024)

Source: Carta (2024) Source: Carta (2024)

Source: Carta (2024)