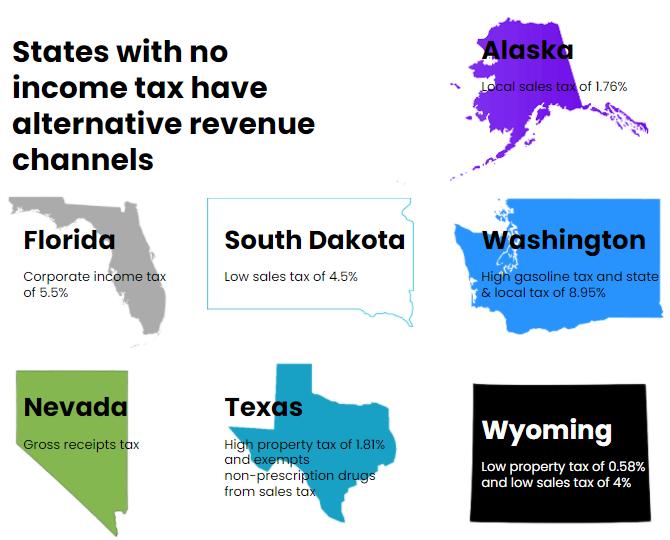

It is easy to forget about the implications of state and local taxes on your income whether it is W-2 wages or capital gains on an investment. If you are an investor be sure to check out your state’s tax treatment of capital gains because they could (i) have no state income taxes, (ii) no capital gains taxes, (iii) follow Section 1202 QSBS capital gains tax exclusion, or (iv) have favorable tax credits/incentives. As of 2020, there are seven “tax-free states” and two states that have no capital gains tax, which is below:

No Income Tax

- Alaska (local sales tax of 1.76%)

- Florida (corporate income tax of 5.5%)

- Nevada (gross receipts tax)

- South Dakota (low sales tax of 4.5%)

- Texas (high property tax of 1.81% but non-prescription drugs are exempt from sales tax)

- Washington (High gasoline tax and a state & local tax of 8.95%)

- Wyoming (Low property tax of 0.58% and a low sales tax of 4%)

No Capital Gains Tax (only tax dividend & interest income)

How does my state treat QSBS capital gains?

This article does not constitute legal or tax advice. Please consult with your legal or tax advisor with respect to your particular circumstance.