Optimize QSBS and

other tax incentives

across your portfolio

Ensure that you and your fellow investors

realize your portion of the over $20B in missed

tax incentive saving each year.

Tax incentives go unclaimed each year

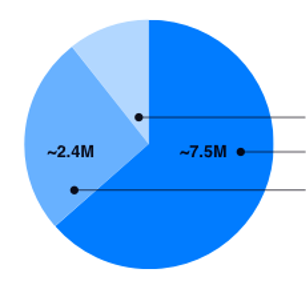

Approximately $20B in missed annual Qualified Small Business Stock (QSBS) savings alone!

QSBS incentivizes innovation by providing shareholders up to 100% capital gains tax savings.

Savings on a

10M gain

Potential state tax savings

Gains not subject to tax

Federal tax savings

Existing solutions only

help with pieces

FULL SUPPORT

PARTIAL SUPPORT

| Gather Portfolio Company Docs |

Analyze Legal & Tax Docs |

Monitor Portfolio |

Assess Incentive Criteria |

Facilitate Sharing with Stakeholders |

Provide Substantiation Analysis |

|

FUND ADMINISTRATION

|

|

|

||||

LEGAL DOC MANAGEMENT

|

|

|||||

PORTFOLIO MONITORING

|

|

|||||

DATA GATHERING TOOLS

|

|

|||||

PROFESSIONAL SERVICES

|

|

|||||

|

|

|

|

|

|

|

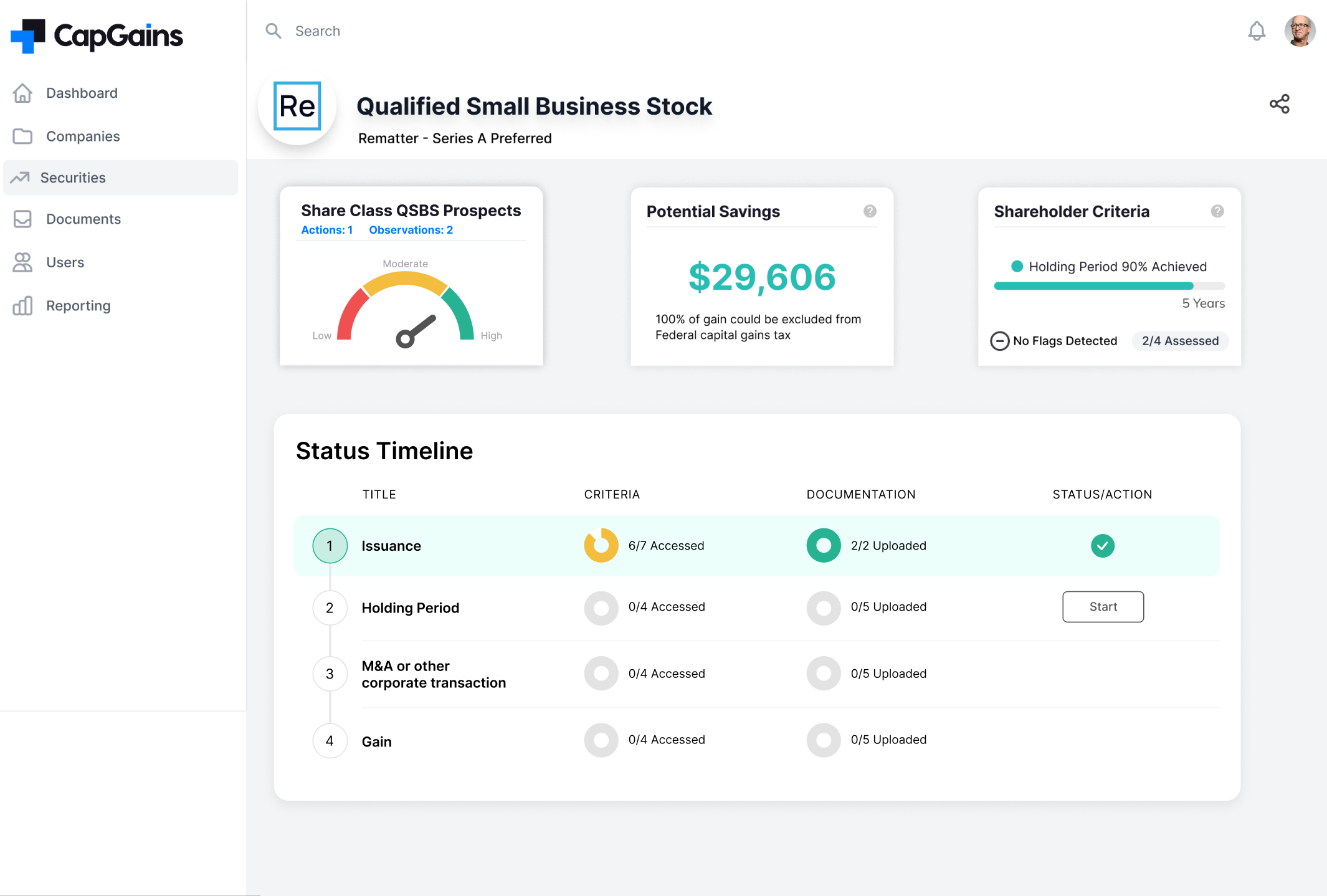

Our process

1. Security Diagnostic

Our proprietary and purpose-built risk assessment benchmarks each security against the multitude of permutations in the criteria

2. Monitoring

We ensure ongoing compliance and flag tripwires, creating confidence of go-forward eligibility

3. Substantiation

We organize all relevant documentation into a bullet-proof corporate summary, to help defend your exclusion

Our software helps you avoid and navigate the multitude of permutations that jeopardize eligibility.

(over 3,000 permutations with QSBS alone!)

- With hundreds of companies analyzed, we identify specific pitfalls to avoid

- Detailed action plans for each portfolio company keeps you on the right side of eligibility

See for yourself