Recent markups to the Build Back Better Legislation include an amendment to the previously-untouched Section 1202, which outlines the Qualified Small Business Stock tax exemption. The House Ways and Means Committee added verbiage that would limit the potential 100% federal tax exclusion of the capital gain recognized on QSBS to taxpayers with an adjusted gross income (AGI) under $400K.

According to the Joint Committee on Taxation, the potential revenue would amount to less than 1% of the cost of the infrastructure bill.

This proposed limitation, which would only allow taxpayers with an AGI above the aforementioned threshold, 400k, to exclude 50% of a qualified capital gain will drastically reduce the number of investors, investment funds, private equity firms, and even founders who would be eligible for a 100% exclusion and incentivized to invest in a Qualified Small Business.

Furthermore, the added layer of complexity on top of an already nuanced section of the IRC could in itself be a turn off for investors, tax advisors, and even entrepreneurs looking to form their own business in a way that promotes innovation and job creation with fiscal reward.

What’s the Big Deal?

So, what’s the big deal if less and less Americans are interested in the potential, although complicated, benefits of QSBS and are less likely to make high risk investments in innovative startups?

Section 1202 QSBS is a crucial pathway between early stage startups and venture capital. Since its inception, this investment strategy has constructed an entrepreneurial ecosystem that cultivates innovation and rewards risk taking. According to JP Morgan & Chase Co., over 99% of American businesses were small businesses as of 2015, with 88% of companies having less than 20 employees. Nearly half of Americans are employed by small businesses and in 2015, 21% of US patents were held by businesses with less than 500 employees.

How many of these employers, already suffering economic turmoil due to the pandemic, will survive if there is no longer an environment that connects them with the capital they need to solve more problems and create more jobs?

Is it Worth it?

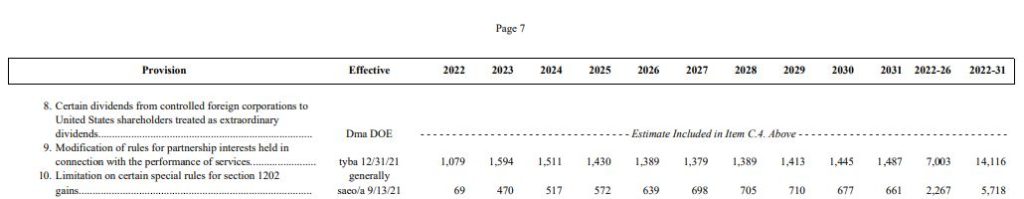

As we see it, this proposed amendment could crush the Venture Capital ecosystem as we know it. And for what? The Joint Committee on Taxation released a report dated September 13, 2021, that outlines the estimated budgetary effects of an amendment of the budget reconciliation legislative recommendations. These estimations are illustrated for fiscal years 2022-2031 and are in millions of dollars.

Page 7 of this document lists “Limitations on certain special rules for section 1202 gains” as a line item and totals the possible revenue collected over 10 years to $5.7 billion. This number, equivalent to about $570 million per year, accounts for less than 1% of the total revenue the amendments recommends necessary to cover the outlined costs.

Section 1202 has historically been a bipartisan triumph. Over its ~30 year lifetime, multiple pieces of legislation have worked to raise the incentive and bet on American small business. While QSBS investors live in the world of risky business, we simply don’t know enough to ensure that 1% of the cost of the Build Back Better Act won’t detrimentally impact the entrepreneurial economy that we know.

This article does not constitute legal or tax advice. Please consult with your legal or tax advisor with respect to your particular circumstance.