On January 24, 1963, John F. Kennedy quotes, “The tax on capital gains directly affects investment decisions, the mobility and flow of risk capital from static to more dynamic situations, the ease or difficulty experienced by new ventures in obtaining capital, and thereby the strength and potential for growth of the economy.” Exactly 30 years later, August 10, 1993, the Public Law No. 103-66 Title VIII Part II Subpart B – Capital Gains Provision was passed by the House of Representatives Budget Committee and added to the Internal Revenue Code (IRC) as § 1202.4 The statute was introduced by a Minnesota House of Representative, Martin Olav Sabo, as an incentive for taxpayers to start and/or invest in certain small businesses with a goal to harvest innovative technologies. Since 1993, there has been a roller coaster of events leading up to today’s peaked interest from investors for the § 1202 capital gains tax exclusion.

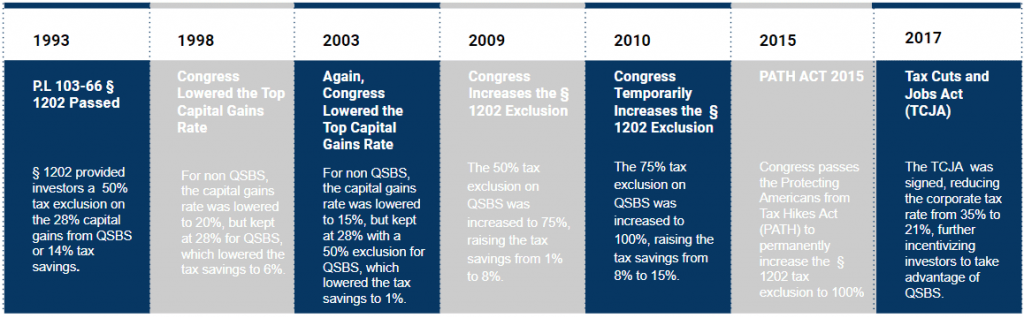

Below is a timeline of key events in QSBS history:

1993 – P.L 103-66 Section 1202 Passed

Section 1202 provided investors a 50% tax exclusion on the 28% capital gains from QSBS or 14% tax savings.

1998 – Congress Lowered the Top Capital Gains Rate

For non-QSBS, the capital gains rate was lowered to 20%, but kept at 28% for QSBS, which lowered the tax savings to 6%.

2003 – Again, Congress Lowered the Top Capital Gains Rate

For non QSBS, the capital gains rate was lowered to 15%, but kept at 28% with a 50% exclusion for QSBS, which lowered the tax savings to 1%.

2009 – Congress Increases the § 1202 Exclusion

The 50% tax exclusion on QSBS was increased to 75%, raising the tax savings from 1% to 8%.

2010 – Congress Temporarily Increases the Section 1202 Exclusion

The 75% tax exclusion on QSBS was increased to 100%, raising the tax savings from 8% to 15%.

2015 – PATH ACT 2015

Congress passes the Protecting Americans from Tax Hikes Act (PATH) to permanently increase the Section 1202 tax exclusion to 100%

2017 – Tax Cuts and Jobs Act (TCJA)

The TCJA was signed, reducing the corporate tax rate from 35% to 21%, further incentivizing investors to take advantage of QSBS.

Why Care About § 1202?

The IRC § 1202 provides a 100% tax exclusion to capital gains on the sale of Qualified Small Business Stock (QSBS) held for 5 years with savings up to the greater of $10 million or 10x the initial investment. Even though § 1202 can create eye-opening tax savings, there are stringent provisions laid out within § 1202 of the IRC. Over the next few weeks, we will be looking under the hood of § 1202 on a federal and state level to provide investors with guard rails to navigate the provisions that cover (i) the timing of the purchase, (ii) the timing of the sale, (iii) what constitutes QSBS, (iv) how to keep a QSBS qualification, and (v) tax strategies and other fine print requirements. To start, below are base QSBS and investor provisions.

This article does not constitute legal or tax advice. Please consult with your legal or tax advisor with respect to your particular circumstance.