Qualified Small Business Stock (QSBS) has long offered significant tax benefits under Section 1202 for investors looking to reduce or eliminate capital gains tax on eligible startup investments. Lesser known, however, is Section 1045, which allows you to preserve QSBS eligibility by reinvesting QSBS proceeds into new qualified small businesses if stock that would be QSBS is sold before the mandated QSBS five-year timeline.

This provision opens the door for creative tax strategies, but it also presents a few challenges—namely a tight 60-day reinvestment window and a limited market of formal 1045 “exchange” opportunities. Let’s break down how Section 1045 works, compare it to other rollover and deferral mechanisms, and explore strategies to use 1045 to your advantage.

How Section 1045 Works

Section 1202 was enacted to help boost capital for qualified, active small business C corporations that:

- Use at least 80% of their assets in active business activities

- Are defined as active businesses under Section 1202 rules

- Don’t exceed $50 million in aggregate gross assets

- Issue QSBS valued at $10 million or 10 times the aggregate adjusted basis

Meanwhile, the QSBS investor selling the stock might not have to pay capital gains taxes on that sale if said investor holds the stock for at least five years. Selling QSBS before the five-year deadline generates realized gains, which can be taxed up to 20% or higher. If the stock is held for less than a year, the gains are taxed as ordinary income based on the investor’s tax bracket.

Using Section 1045 rules to roll over the gains into another QSBS might help. To succeed with this process, the investor must:

- Hold the original QSBS investment for at least six months

- Reinvest the gains into replacement qualified small business stock within 60 days of the original QSBS sale

- Reinvest in a company that remains eligible for QSBS status six months after investment

The Section 1045-Section 1202 partnership means investors could defer capital gains taxes if an original QSBS sells before the five-year deadline. It also means that the Section 1202 tax gain exclusion could be in play if the investor demonstrates a five-year combined holding period for the original QSBS and replacement QSBS.

In addition to tax advantages, QSBS rollover strategies can offer the following:

- Portfolio diversification: Selling the original QSBS and rolling over your sales proceeds to other qualified small businesses in different industries could help spread the investment risk and potential downsides.

- Seeking opportunities with a different risk profile: Investors with rollover eligible gains may wish to seek alternative investments with a lower risk profile than an early-stage “startup.” Several such opportunities have been developed to fit this profile. Contact us (using the below button) to learn more.

Additional Tax Deferral Methods

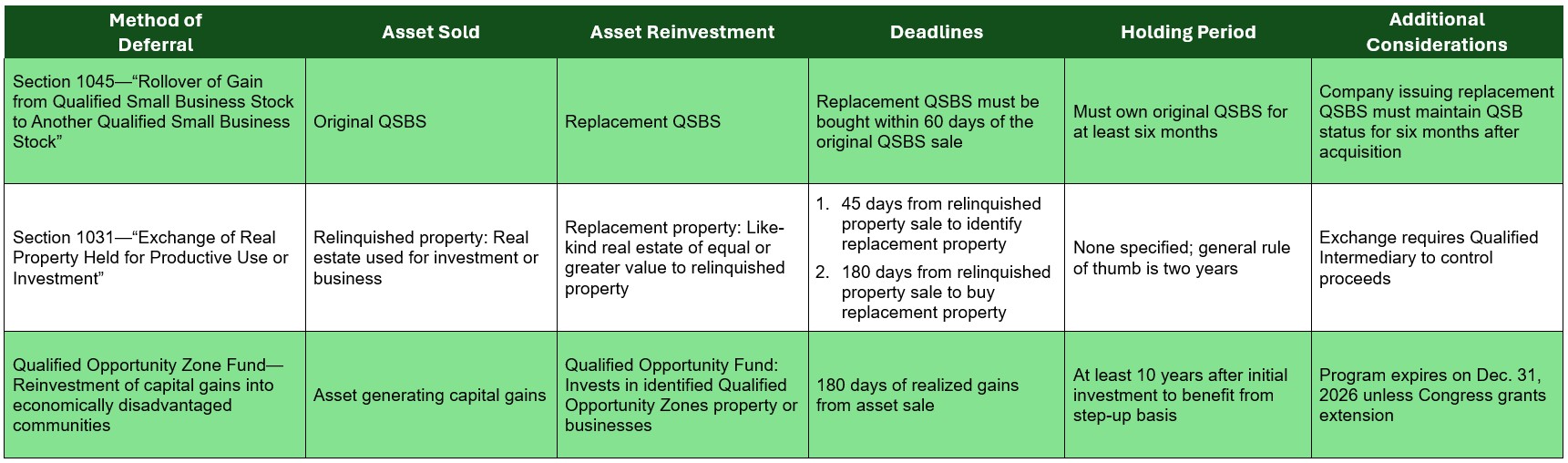

The Section 1045 rollover is one way to help defer capital gains taxes. Other well-known methods include Section 1031 and the Opportunity Zone program. However, each method has different rules and deadlines. For example:

- Section 1031—“Exchange of Real Property Held for Productive Use or Investment”—can help an investor defer capital gains taxes and depreciation recapture on the sale of real estate held for business or investment use.

- The Opportunity Zone Program, part of the Tax Cuts and Jobs Act of 2017, allows the investor to invest capital gains from the sale of any capital asset into a Qualified Opportunity Zone Fund, which then reinvests the proceeds into federally designated Opportunity Zones. If held for at least 10 years, the investor could permanently exclude gain from the investment when it’s sold or exchanged.

The chart below compares the three tax-advantaged tools:

Adding More Liquidity to Investment Strategies

While Section 1202 offers potential incentives for QSBS investors, Section 1045 can provide tax-advantaged benefits if QSBS is sold before the five-year hold period ends. Less money is earmarked for taxes, which can improve investment opportunities.

However, using both tools for portfolio strategies can be complex. Our QSBS experts can help investors determine if a target entity issuing qualified small business stock meets Section 1202 requirements. Furthermore, our team can guide investors through the Section 1045 rollover process. To learn more, contact us to set up a no-obligation portfolio analysis today.

This article does not constitute legal or tax advice. Please consult with your legal or tax advisor with respect to your particular circumstance.