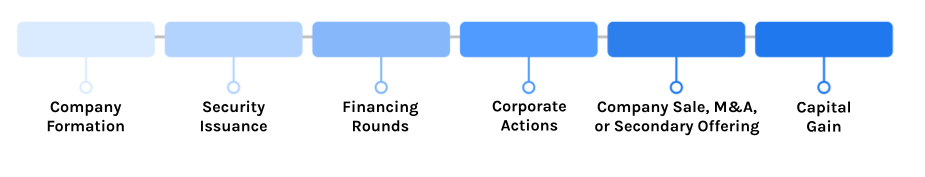

Continuous implications regarding tax incentives can occur throughout the corporate lifecycle. Refer below for further details across the corporate lifecycle.

Company Formation

Founder

Individual Investor

Investment Fund

In order to issue QSBS stock, a company first needs to be a Qualified Small Business. Expand to explore the eligibility criteria further.

Key QSBS requirements:

- Eligible entities

- Active Business Requirements

- Qualified Trade or Business

- Aggregate Gross Assets

- Eligibility can be jeopardized by certain corporate actions such as stock redemptions. See “Corporate Actions” section for further details.

Security Issuance

Learn more QSBS acquisition and how different security types may or may not qualify for QSBS.

Certain rules dictate the acquisition of Qualified Small Business Stock from an eligible company. Additionally, in order to recognized the federal exemption, a 5-year holding period must be observed by the shareholder.

Financing Rounds

Learn more about important financing considerations.

The Gross Asset Test is an important eligibility factor of a Qualified Small Business. The date at which a company exceeds $50 million in aggregate gross assets changes the company’s ability to issue QSBS in the future.

Learn more about these documents and what should be included.

Qualified Small Businesses can provide investors with representations and covenants that show the company’s current eligibility as well as future strategies to maintain eligibility.

Corporate Actions

Learn more about how you can protect QSBS status and avoid potentially disqualifying actions.

Certain corporate actions, including stock redemptions and repurchases, can be detrimental to the eligibility of certain Qualified Small Business Stock.

Company Sale, M & A or Secondary Offering

Learn more about how these corporate events can impact your eligibility.

Mergers and Acquisitions, SPAC Acquisitions, company sales, and secondary offering can all have an effect on an eligible company and its shareholders in terms of QSBS status.

Capital Gain

Learn more about the required documentation for filing and additional options including 1045 rollovers and 1244 capital losses.

Congratulations! You have made it through the 5-year holding period and avoided some of the tricky pitfalls that can jeopardize your eligibility. Now it’s time for the reward of QSBS.