Confidently Claim your QSBS Savings

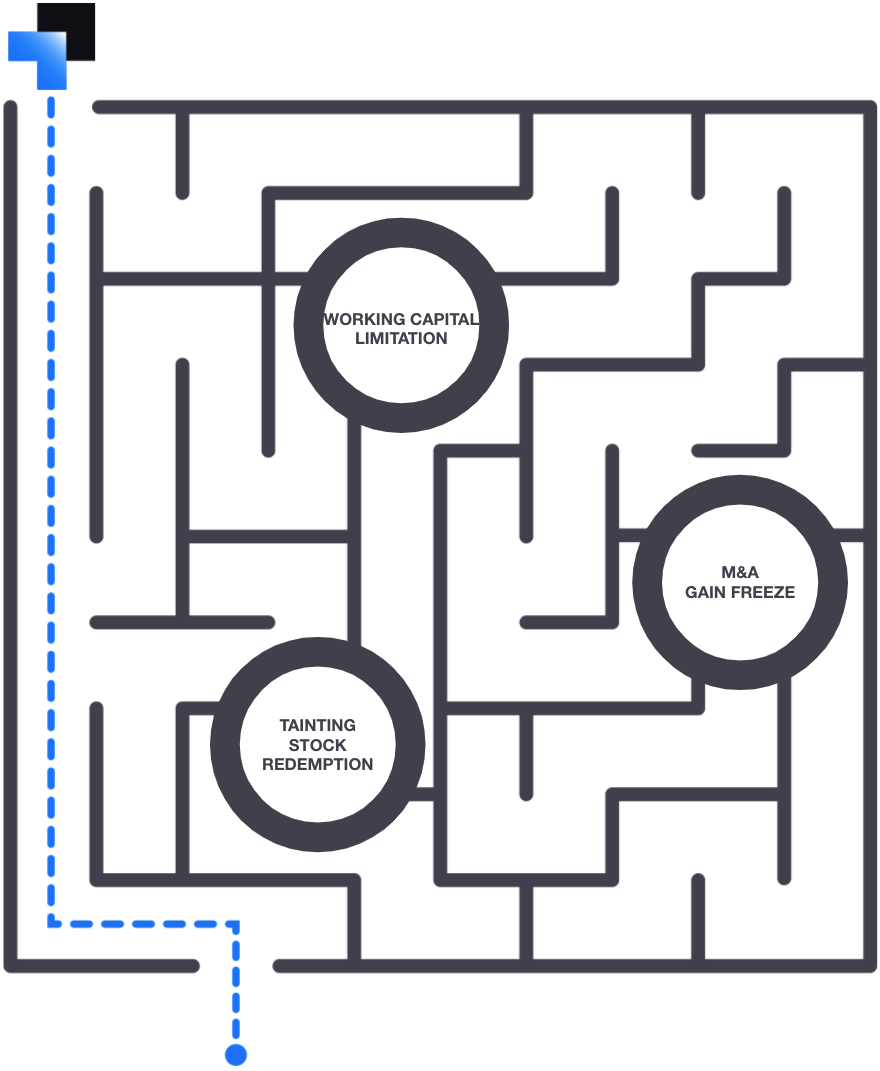

QSBS provides up to 100% capital gains tax savings, however contains a maze filled with countless tripwires which extinguish eligibility.

CapGains is here to help guide you through the maze to substantiate and support that your gains qualify.

CLAIM YOUR SAVINGS

Why validate your eligibility?

Your tax advisor needs you to support that you qualify for the up to 100% capital gains tax savings.

Claiming QSBS exclusions makes you more prone to an IRS audit

QSBS opens up various estate planning opportunities

Missing out on other estate planning and tax savings opportunities

Rest assured that you did all you can to claim your savings with confidence.

Penalties and Interest if eligibility is not supported

Your capital gains may be tax-free! Get started today validating if your gains are eligible.

Substantiation = Peace of Mind

Tax incentive rules are extensive and often ambiguous. Don’t let confusion or ignorance prevent you from taking advantage of savings.

STEP 1

Calculate your potential QSBS tax savings.

STEP 2

Use our self-guided portal to check the prospects of your shares meeting the individual and corporate criteria.

STEP 3

View your QSBS Confidence Score.

STEP 4

Review your QSBS substantiation package and file your return with confidence!

Get peace of mind with every report

![]()

Data Security

We store your data securely, encrypting it in transit and at rest. We will never rent or sell your data to another party.

![]()

Audit Defense

While claiming tax exclusions increases the chances you’ll be audited, we’re here to help and will support you throughout the entire process should the tax authorities have additional questions.

![]()

Our Guarantee

We stand by our work. If the tax authorities reject your claim, you’re covered in the case that we made an error.

The  Report

Report

Confidently Claim Your Savings

QSBS CORPORATE ANALYSIS

Understand what makes your company QSBS eligible

- In-depth corporate eligibility analysis

- Understand benefits to all shareholders at exit

SHAREHOLDER SUBSTANTIATION

Ensure QSBS eligibility

- Individual taxpayer summary

- Gain confidence in your eligibility

SECURITY ASSESSMENT

QSBS Certification / Reporting

- Support documentation & analysis

- Feel confident about issuing QSBS to your shareholders

Not sure if you’re ready for a substantiation report?

Report

Report