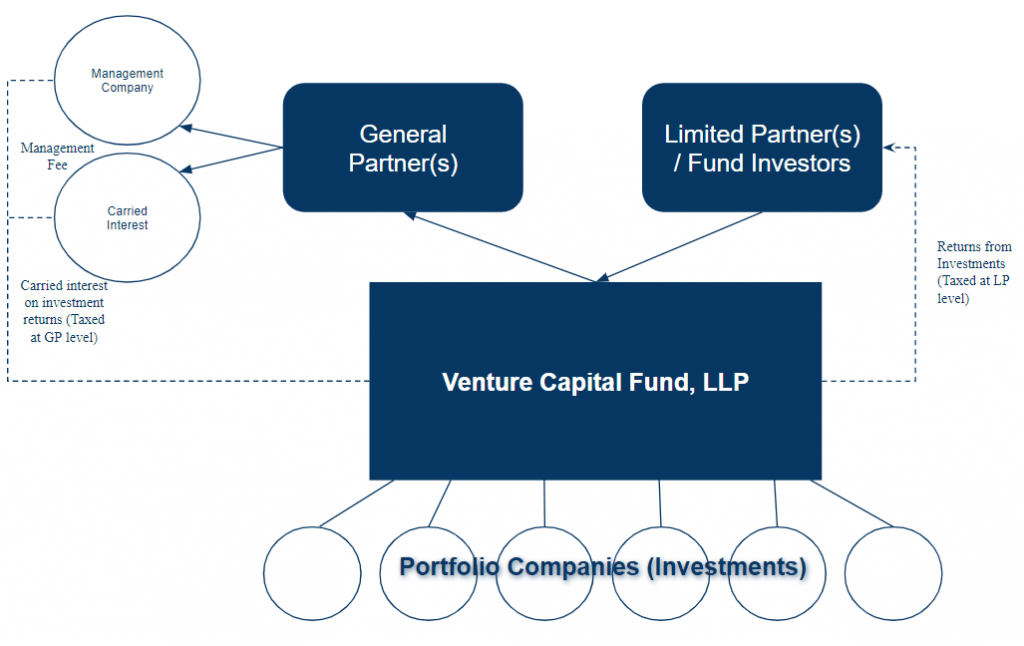

Individuals and pass-through entities are considered eligible investors for QSBS purposes. Venture Capital (VC) firms are formed under a limited liability partnership (LLP) legal structure, which is a pass-through entity. Therefore, limited partners (investors) in a VC firm will be able to take advantage of the Section 1202 QSBS tax exclusion if the portfolio companies pass the QSBS tests. If you are an investor in a VC firm and a liquidation event happens with one of the VC firm’s portfolio companies you will receive a k-1 from the VC firm’s 1065 partnership tax return with the QSBS tax exclusion. Below is an example of a venture capital legal structure.

What is carried interest?

Does carried interest qualify for QSBS?

What is the management company?

What is a k-1?

How do I find venture capital firms to invest in?

This article does not constitute legal or tax advice. Please consult with your legal or tax advisor with respect to your particular circumstance.