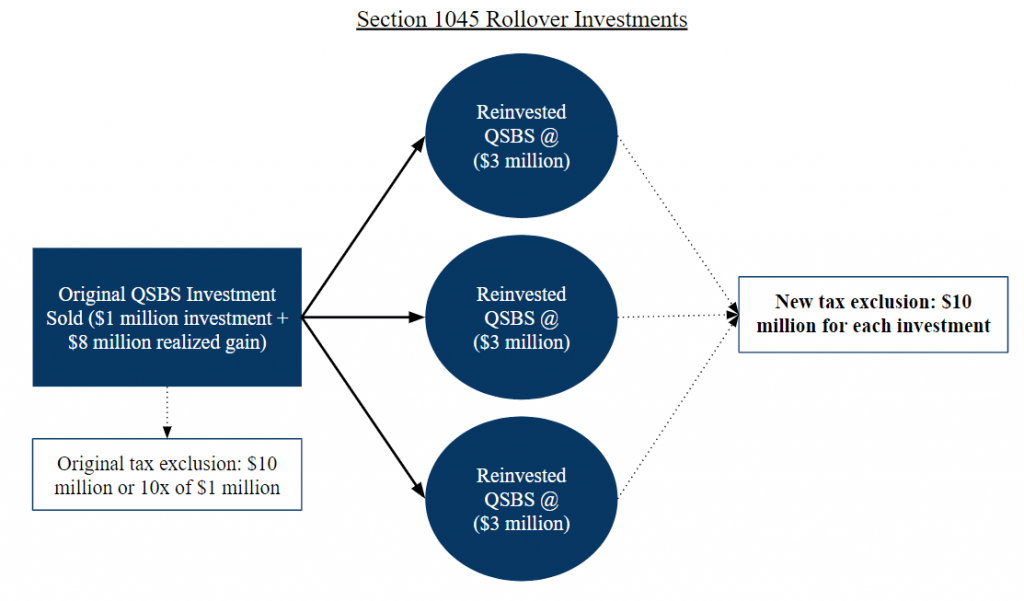

Section 1045(a)(1) says the cost of “any QSBS purchased by the taxpayer” will reduce and defer the realized gain. Therefore, the seller of QSBS can make multiple investments within the 60 day period. As a Section 1045 rollover strategy, multiple investments allows the taxpayer to spread their investment risk across multiple portfolio companies. Also, reinvesting the QSBS gains into multiple investments maximize the tax exclusion potential because there will be more than one bucket of QSBS gains. For example, if you reinvested into three QSBS companies your Section 1202 tax exclusion would be $10 million for each investment not $10 million total.

This article does not constitute legal or tax advice. Please consult with your legal or tax advisor with respect to your particular circumstance.