Not sure if the stock you’re invested in is QSBS, learn more about our QSBS Monitoring Platform

In order to qualify as a “Qualified Small Business”, Section 1202 requires the stock to meet the “Gross Asset” test, whereby the “aggregate gross assets” of the corporation:

- Did not exceed $50 million at all times between August 10, 1993 (enactment of the Revenue Reconciliation Act of 1993) and the date of issuance, and

- Immediately after the issuance, including the amounts received in the issuance, do not exceed $50 million.

(Section 1202(d))

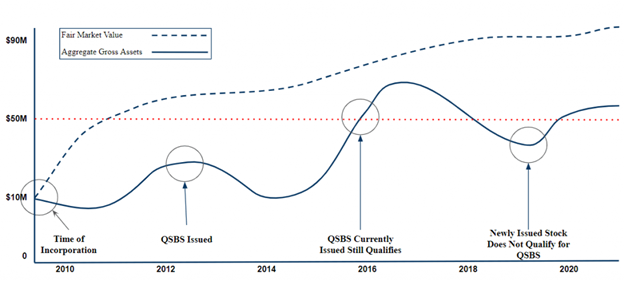

The QSBS asset test or size test means that the aggregate gross asset value of the business must be below $50 million at all times before and immediately after the issuance of QSBS. If assets are ever over $50 million the business will not at any time qualify for QSBS in the future, but QSBS issued before exceeding the threshold will still qualify.

As shown in the below timeline of when a corporation qualifies as a qualified small business, it is ok for the corporation to exceed $50 million in gross assets during the required 5-year holding period after the QSBS is issued. However, additional securities issued at a later time would not qualify as QSBS if the Gross Assets exceeded $50mm at any point before issuance of those securities.

How do I calculate the aggregate gross assets of the business?

This article does not constitute legal or tax advice. Please consult with your legal or tax advisor with respect to your particular circumstance.