The venture landscape is changing. Revolution, a D.C.-based investment firm focused on backing transformative companies outside Silicon Valley, recently released its latest Rise of the Rest report, highlighting a major trend: in 2024, $16.82 billion in capital flowed beyond traditional coastal hubs.

Through Rise of the Rest, Revolution’s seed-stage fund dedicated to emerging markets, the firm has tracked how founders putting down roots across America’s interior are uncovering a powerful advantage: eligibility for tax benefits under Section 1202’s Qualified Small Business Stock (QSBS) provisions.

For investors scanning the horizon for new opportunities, these emerging markets offer more than just new deal flow. Unlike coastal hubs wrestling with intense competition and soaring valuations, companies in America’s heartland are quietly building profitable businesses while maintaining their QSBS status. From Tennessee to Iowa, state governments are rolling out incentives that make these regions even more attractive to qualifying ventures.

Where Growth Meets Tax Planning

Early-stage rounds outside traditional tech centers have nearly doubled in size since 2013, now averaging $5.16 million. This increase is changing not just how companies scale but also how they qualify for QSBS tax benefits. For investors seeking tax advantages, it’s crucial to invest early—before companies hit these qualifying milestones. This is especially important in states that provide additional perks on top of federal QSBS provisions.

Detroit tells this story well. When Ford anchored its mobility innovation district at Michigan Central station, it sparked a wave of startups testing autonomous vehicle technology. Since 2013, local venture funding has tripled. More importantly for tax planning, many of these companies have maintained their QSBS-qualified status, even while partnering with major automakers.

State Policies Create New Options

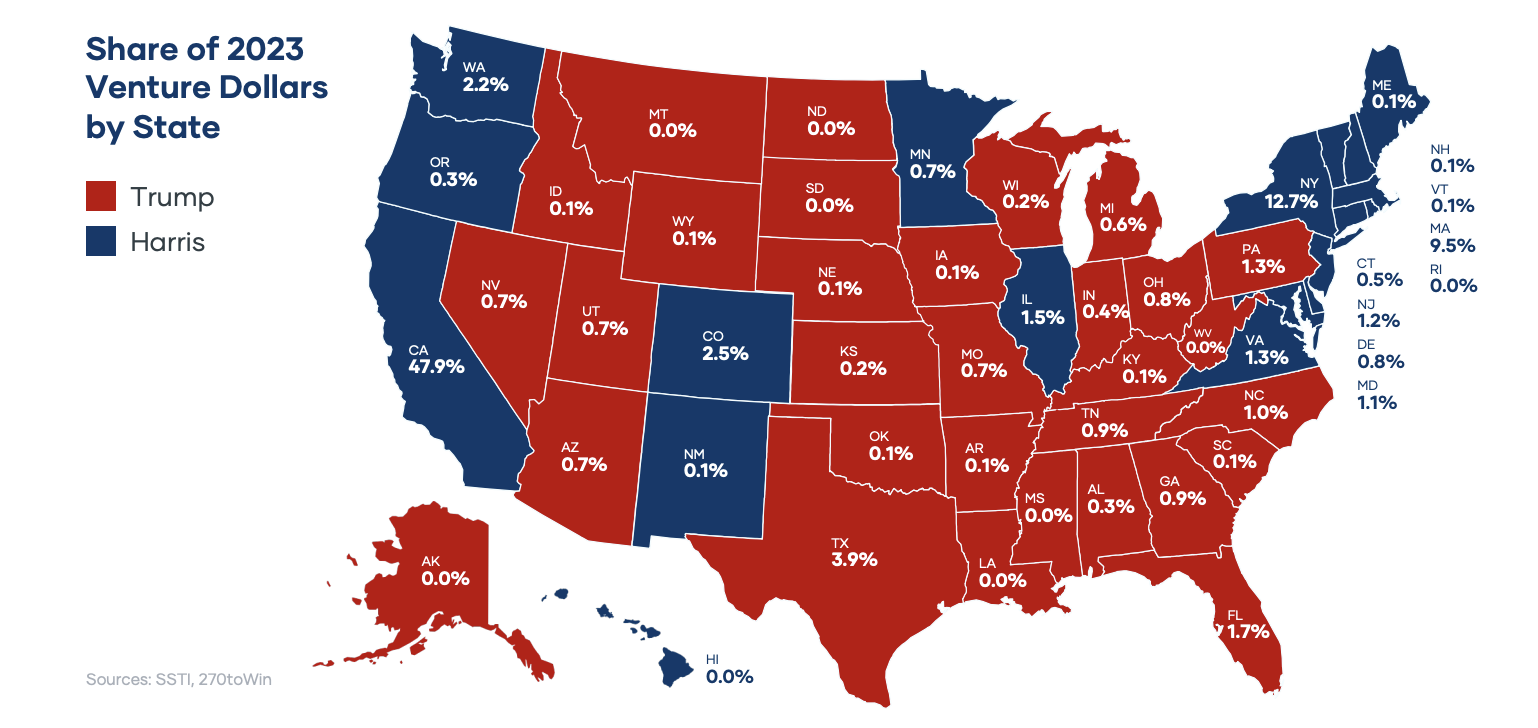

The tax implications of where you invest are constantly evolving. New York mirrors federal QSBS treatment dollar for dollar. Massachusetts doubled its benefits for qualifying sales after January 1, 2022—moving from 50% to 100% exclusion to match federal levels. California, meanwhile, offers no QSBS benefits at all.

These differences in state policies can influence founders’ decisions—some even consider relocating before a significant liquidity event or valuation to maximize tax advantages.

As state support for innovation continues to grow, programs like Nevada’s Right to Start Act have sparked similar initiatives in Michigan, Kansas, and Missouri. The Commerce Department has also committed $504 million to regional tech hubs. For both companies and investors, these evolving policies impact how businesses retain their QSBS-qualified status and determine optimal entry points for investment.

Understanding QSBS Benefits in Rising Cities

The growth of startup ecosystems outside traditional tech hubs offers distinct tax planning advantages. Take Minneapolis, where medical device startups often stay under the $50 million asset threshold through early growth stages. The city’s deep healthcare expertise attracts talent, while state policies help companies maintain their qualified status during R&D phases.

Kansas City shows similar patterns with agricultural technology—in 2022, $205 million in early funding went primarily to companies addressing real industrial problems rather than chasing tech trends.

For investors, these regional dynamics create compelling opportunities. A qualified investment in St. Paul, for example, could result in millions more in tax savings at exit compared to a similar stake in San Francisco. The combination of lower operating costs and supportive state policies allows companies to grow while preserving their QSBS status.

Planning Your Approach

If you’re considering regional investment opportunities with startup success potential, here are three core components to keep in mind:

- Timing considerations: Entering before companies exceed the $50 million gross asset mark can significantly impact your tax treatment at exit.

- State policy advantages: In regions where state programs align with or amplify federal QSBS benefits, your returns can increase substantially.

- Qualified trade considerations: Companies in certain industries—such as SaaS platforms, AI startups, renewable energy, and agriculture tech—are more likely to meet QSBS criteria. Understanding these distinctions ensures that the companies you’re investing in maintain their qualified status as they grow.

Revolution’s data indicates that the shift toward regional innovation will continue to gain momentum. While California—a long-time magnet for early-stage investment—still accounted for 50% of early-stage deals in 2024, some of the most compelling opportunities may now be found in markets where local expertise, tax advantages, and genuine innovation intersect.

Contact CapGains to learn how these regional opportunities can fit into your investment strategy. Our team helps investors capitalize on both the growth potential and tax advantages in America’s rising tech hubs.

This article does not constitute legal or tax advice. Please consult with your legal or tax advisor with respect to your particular circumstance.