Under IRS Top No. 409 a taxpayer has a capital gain for the amount received over the adjusted basis of their exchanged property. This gain could be short or long-term depending on the holding period. Section 1202 states “the adjusted basis of any property contributed to the corporation (or other property with a basis determined in whole or in part by reference to the adjusted basis of the property so contributed) shall be determined as if the basis of the property contributed to the corporation (immediately after such contribution) were equal to its fair market value as of the time of such contribution.” This means that the gain on the property happened before the issuance of the stock; therefore, Section 1202 does not cover the gain on the exchange of property for QSBS. Capital gains taxes will be paid on the transaction involving appreciated property for QSBS. Although Section 1202 does cover the built-in gain, the basis in the QSBS will include the built-in gain, giving the taxpayer a higher basis for the QSBS exclusion cap.

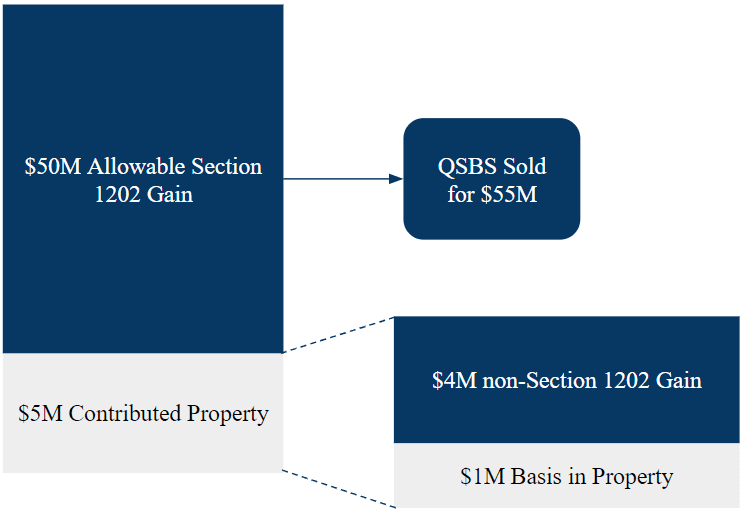

Below is a hypothetical example.

A taxpayer owns land with a basis of $1M and a recent appraisal of $5M, giving the investor a fair market value of $5M and an unrealized gain of $4M. The taxpayer exchanges the property for $5M worth of QSBS in ABC Corp. The taxpayer realizes the $4M gain on the appreciated property as long-term capital gains. The basis in the QSBS is $5M; therefore, the taxpayer can exclude gains up to $50M ($5M x 10) instead of taking the basis in the land and excluding gains of up to $10M ($1M x 10).

This article does not constitute legal or tax advice. Please consult with your legal or tax advisor with respect to your particular circumstance.