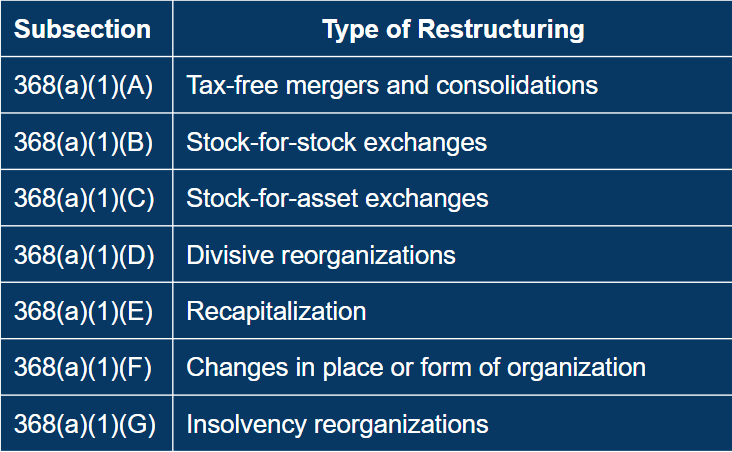

A Section 368 tax-free E reorganization or recapitalization can involve various structures, but the most commonly used structure for QSBS is a stock for stock exchange or assets for stock exchange. The tax-free reorganization will defer any gains recognized at the time of the sale until the exchanged stock is sold. The QSBS holding period and tax exclusion will not be affected in the tax-free exchange. The acquiring company will exchange stock for controlling interest in the target company. If the stock exchange for the QSBS company, target company, is non-QSBS then the QSBS tax exclusion will be limited to the built-in gain at the time of the exchange and any gains thereafter will be taxed as long-term capital gains. When the QSBS company is acquired in exchange for QSBS the exchanged stock will be treated the same as the original QSBS as if nothing had happened. Below are the different tax-free restructurings under Section 368.

Hypothetical Example

After three years of being incorporated a startup company was acquired through a Section 368 stock for stock exchange by an incumbent corporation. The incumbent, acquiring corporation, exchanged QSBS for a controlling interest in the startup company for a realized gain of $5 million to each stockholder. The holding period and gains of the original issued QSBS will transfer to the exchanged QSBS; therefore, the built-in capital gains of $5 million from the exchange will be excluded under Section 1202 if they are sold in two years or later. Also, any new gains on the exchanged QSBS will be excluded as long as they do not exceed the tax exclusion cap.

This article does not constitute legal or tax advice. Please consult with your legal or tax advisor with respect to your particular circumstance.